The board of directors of the oil company YPF approved a plan to optimize its portfolio of conventional fields, which will lead it to focus its investments on more profitable conventional and unconventional areas, the company said in a statement.

The assessment of the assets that will be part of this rationalization plan resulted in an estimated impairment of $1.8 billion as of December 31, 2023, YPF added.

"The rationalization plan aims to optimize the conventional upstream portfolio, allowing the company to continue developing conventional and unconventional areas that will provide greater profitability to the company and its shareholders for every dollar invested, through better allocation of its technical and economic resources," the company said in the statement.

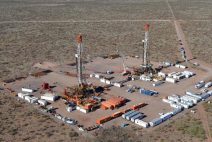

A company source said that details of the plan, which analyzes 55 conventional areas located in northern Santa Cruz, some in Chubut, Mendoza, and Neuquén, will be provided in the coming months.

"YPF will actively collaborate with local development and guarantee jobs during the transition, understanding that this process dynamizes the industry as a whole, as new local SMEs (small and medium-sized enterprises) will be able to provide employment and development to each region by exploiting areas that otherwise could not do so," the company said.

YPF, the country's largest oil company, aims to quadruple its market value over the next four years with the boost from the unconventional Vaca Muerta formation, a company source said in early February.