OPEC: The oil sector needs $17.4 trillion by 2050

The Organization of the Petroleum Exporting Countries (OPEC) reiterated its view that the global oil sector requires $17.4 trillion in investments by 2050, averaging $650 billion per year

The Organization of the Petroleum Exporting Countries (OPEC) reiterated its view that the global oil sector requires $17.4 trillion in investments by 2050, averaging $650 billion per year.

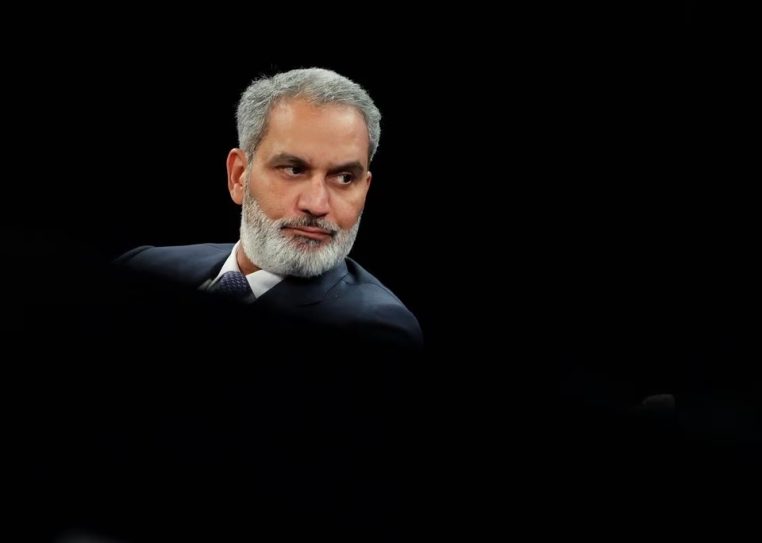

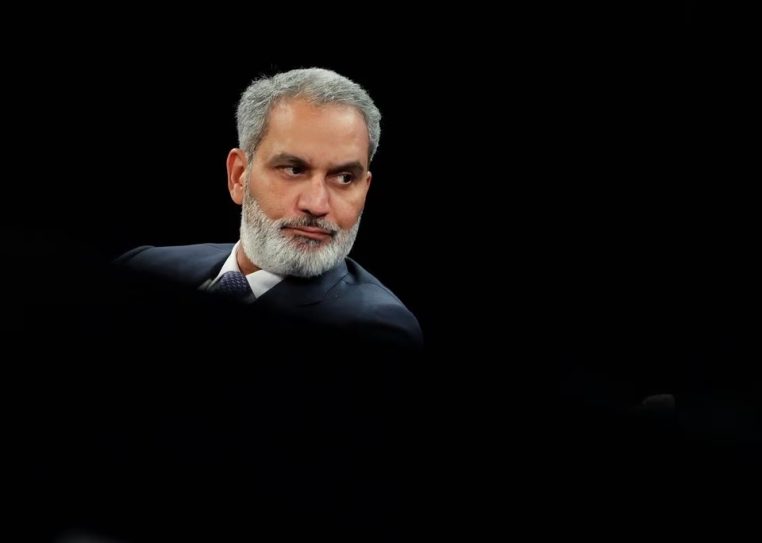

"We need investment, investment, and more investment," emphasized OPEC Secretary General Haitham al-Ghais, from Kuwait, in an article titled "Redefining Energy Transitions" published on the organization's website, headquartered in Vienna.

In the article, Al-Ghais elaborates on the well-known stance of petro-states, vigorously defended at recent climate conferences, that oil and gas will remain crucial for ensuring the planet's energy security. He argues that alternative sources should complement existing ones rather than replace them.

This thesis contrasts with forecasts predicting that global hydrocarbon demand will peak by the end of this decade and then enter a definitive decline, as estimated by the International Energy Agency (IEA), which represents the energy interests of major industrialized nations.

"It is a narrative that some believe is set in stone and should not be questioned. This is a mistake," asserts Al-Ghais in his article, warning against what he views as an unrealistic future that could lead to significant challenges in energy security, energy availability, emission reductions, and a lack of necessary investments.

"Despite reports about the imminent peak of oil demand, the world continues to consume more oil year after year. This is a trend we've seen in the past in the energy sector, and we have no doubt it will continue in the future, given the population growth in developing regions, urbanization, and economic expansion," Al-Ghais stresses.

"At OPEC, we see the global oil industry needing investments worth $17.4 trillion by 2050, which amounts to nearly $650 billion annually," he adds, recalling the long-term forecasts for the global oil market published last September in Rio de Janeiro.

"Considering all of this, isn't it time to rethink how we understand the term 'energy transition'? The past has shown us that our future has never been about replacing energy sources but about adopting new ones and continuously finding new uses for them," proposes the OPEC Secretary General.

OPEC was founded in 1960 by Venezuela, Saudi Arabia, Iran, Iraq, and Kuwait to coordinate their policies to protect the income levels of these countries through oil exports.

Currently, it has twelve members, along with ten allied oil-producing countries, including Russia, Mexico, and Kazakhstan, who regularly meet to set their crude oil supply levels and thus influence barrel prices.

After withdrawing 5.86 million barrels per day (mbd) of crude from the market since late 2022, the so-called 'OPEC+ alliance' (OPEC and allies) is currently pumping about 40 mbd, accounting for approximately 39% of the world's oil supply.