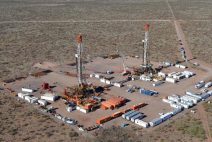

Vista, Argentina's second-largest unconventional oil and gas operator, plans to invest around $1.1 billion in 2024 to accelerate production in Vaca Muerta, the company’s founder and CEO, Miguel Galuccio, told Reuters.

The Vaca Muerta formation, one of the largest shale reserves in the world, has become Argentina's main hope to reverse a historic energy deficit that has impacted its trade balance and to generate much-needed foreign currency for the economy.

The company will invest in more wells and infrastructure to boost transport capacity from Vaca Muerta, Galuccio said in an interview from New York after celebrating five years of trading on the New York Stock Exchange (NYSE), where Vista’s stock has risen over 460% in dollars since its launch.

"In 2023, our biggest bottleneck was infrastructure, and it’s not 100% resolved yet," explained Galuccio, noting ongoing projects by Oleoductos del Valle (Oldelval) to double the evacuation capacity of oil through the Vaca Muerta Sur pipeline, stretching from Neuquén to a port in Rio Negro, and the Vaca Muerta Norte pipeline, aimed at reaching Chile.

Vista, which added a third drilling rig this year and will bring in a second fracturing set, increased its production from 50,000 barrels of oil equivalent per day (boe/d) in 2023 to 65,000 boe/d in the second quarter of this year, with an average production target of 70,000 boe/d until reaching 85,000 boe/d in the fourth quarter, according to Galuccio.

The company aims to reach 100,000 boe/d by 2026 and 150,000 barrels by 2030.

Vista's lifting cost was $4.5 per barrel in the second quarter, but Galuccio believes the company could reduce it to $4 per barrel by 2026.

“We started with a lifting cost of $18, and we’ve been lowering it steadily. Today we are approaching a technical limit,” he explained. However, he added, “We could still aim for $4; we could shave off another 50 cents by 2026.”

Galuccio, an oil engineer who worked abroad for many years, returned to Argentina in 2012 to become the CEO of YPF, the country’s largest oil company—controlled by the state—where he pushed for the development of Vaca Muerta, the world’s second-largest shale gas reserve and fourth-largest shale oil reserve, until he left in 2016.

"In 2012, Vaca Muerta was for believers. Today, Vaca Muerta is for engineers," Galuccio recalled about the early days of exploration.

However, the country is still far from fully developing Vaca Muerta, which covers an area similar in size to Belgium.

"Vaca Muerta needs more companies like Vista and more investment," Galuccio said, highlighting the recent approval by Congress of a law that included export liberalization and non-interference by the government in local hydrocarbon market prices.

“These two concepts are good for the industry, which is crucial for generating foreign currency for the country," he explained. “The third element that could help significantly is lifting capital controls, as they remain a restriction for foreign investors.”

Galuccio estimated that Vaca Muerta could produce 1 million barrels per day by 2030, generating around $20 billion per year for Argentina.

"A humid pampas without the risk of rain," he noted, referencing the importance of the agricultural sector as a key foreign currency generator for the country.