OPEC tells IMF that oil price rally mainly due to geopolitics

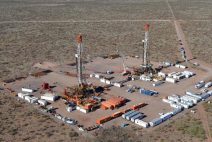

OPEC told the International Monetary Fund’s steering committee that the surge in oil prices was largely due to the Ukraine crisis, in the latest signal that the producer group would not take further action to add supply