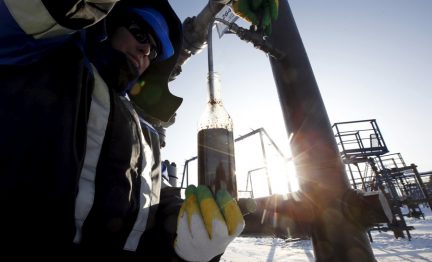

Oil set for weekly gain on Saudi output cut pledge

Brent crude climbed 44 cents, or 0.8%, to $54.82 a barrel by 1007 GMT, the highest since late February, and U.S. West Texas Intermediate (WTI) gained 36 cents, or 0.7%, to $51.19, also its highest level since late February