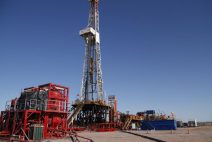

Russia backs OPEC+ 500,000 bpd oil output hike from February

Russia expects to support an increase in oil production by the group, known as OPEC+, of another 500,000 barrels per day from February at next month’s summit of the leading global oil producers