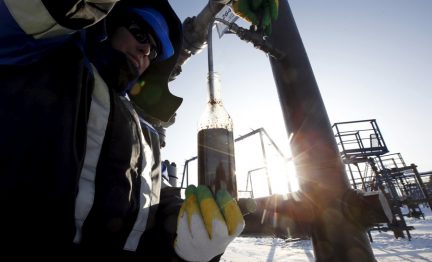

Barclays raises 2020 oil price outlook

The bank raised its 2020 Brent and US West Texas Intermediate (WTI) price forecasts by $2 to $43 per barrel and $39, respectively. For 2021, the bank expects Brent and WTI prices to average $53 and $50 per barrel, respectively.